In an era marked by the relentless shrinking of the world into a global village, the dynamics of fiscal management are changing the landscape of household budgets. The days of relying on a single breadwinner per household are fading into memory. Today, it’s imperative for every adult family member to contribute to the financial well-being of the household. Even when life seems smooth, it’s crucial for young individuals to master the art of financial independence.

Life has many chapters, and unforeseen challenges lie ahead. Why should the youth endure years of financial struggle when they could become financially independent earlier? Why should university graduates wander from one company to another with their degrees growing colder by the day? Why should job seekers accept the bleak economic landscape as it is? It’s high time to challenge the conventional idea of job-seeking and embark on the journey of job creation.

Knowledge is the precursor to action. Before money lands in your hands, financial literacy is essential to avoiding a financial disaster. According to the Global Financial Literacy Survey (2015), only 26% of Pakistani adults are financially literate. Learning starts at home, and the first step in nurturing financially independent youth is teaching them about finances.

Parents’ Role:

Parents should always encourage their children to ask questions about finances. Sadly, the tradition of not discussing financial matters with children has left many young adults with little decision-making power later in life due to financial illiteracy. This, in turn, leads to unstable incomes or the sale of assets. It’s time to dispel this myth. Encourage your children to ask questions and satisfy their curiosity. Involve them in your financial matters, stimulate them to share their opinions, and allow them to analyze your mistakes to learn from them. Don’t buy them everything; instead, give them a small allowance with guidance on managing expenses. Let them learn the value of money through practical experience. Don’t pamper them; let them grow into responsible individuals.

The Societal Role:

The National Financial Literacy Program Phase 2 (2022-2027) aims to reach 12,000 beneficiaries across 51 cities by 2023, with a strong emphasis on addressing financial literacy among females. Banks can collaborate with educational institutions to promote financial literacy through weekly classes or short-term courses on fiscal management. Additionally, engage with independent sources such as The Teen Trillionaire, which offers free workshops on financial basics. Organizations like Fly to the World have developed comprehensive curricula for teaching financial management. Educational institutes should consider hosting these seminars. Teachers also play a crucial role by encouraging extra reading on financial topics, such as “Rich Dad, Poor Dad.” Society’s involvement is paramount to improving the current dismal financial literacy rate.

In-Demand Skills:

As the job market evolves with new skills in high demand, educational institutions from high school to university should consider offering short-term courses in trending skills. Instead of investing solely in extracurricular activities, allocate resources to teach practical skills that can create personal financial opportunities under expert guidance.

Internships:

The government’s role is pivotal in offering paid internships to young individuals in both the public and private sectors. Implementing an e-system for reviewing applications will ensure transparency and greater participation. Internship positions should be available during summer and winter breaks to accommodate students’ schedules. This approach benefits both young individuals who gain experience and offices that receive valuable assistance. Expanding internship opportunities to college students, in addition to university graduates, would be a logical step.

Assistant Teachers:

Universities in Pakistan could adopt the practice of hiring teacher assistants, similar to leading universities worldwide. These assistants could assist professors with various tasks, including conducting tutorial classes, while also earning a stipend and enhancing their CVs.

Scholarships:

While distributing cars, bikes, laptops, and cash prizes may seem innovative, they can lead to inevitable debts and loans for students. Scholarships should be disbursed monthly, with the awarding body paying tuition fees directly to educational institutions. This approach ensures that financial support directly contributes to uninterrupted study periods.

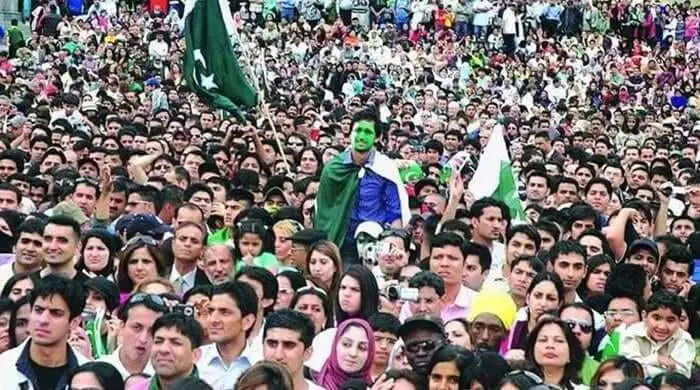

Crisis and difficult times should serve as catalysts for growth, not excuses for avoiding hard work. To uplift Pakistan from its economic challenges and bolster our resilience as a nation, we must unite and work together. The path to achieving this lies in nurturing financially independent youth, empowering them for a sustainable future. As the saying goes, “United we stand, divided we fall.”